Financial Storytelling: The Changing Role of the CFO

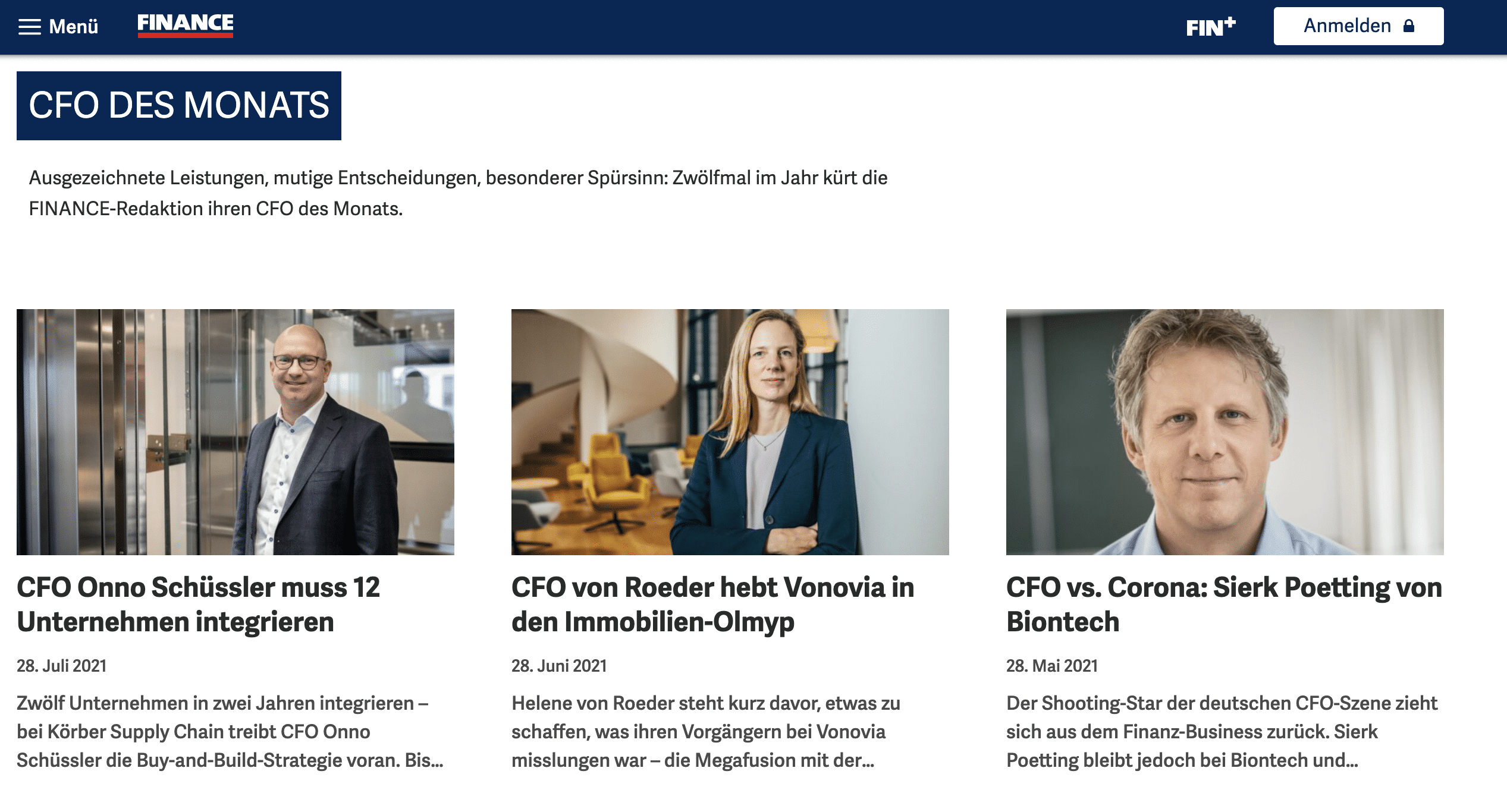

Every month, FINANCE magazine chooses the CFO of the month in Germany. Reading through these articles, some typical buzzwords are confirmed: Organizing portfolios and investments, growth, profitability, expanding market share, cutting costs, optimizing liquidity, going public, working capital, etc. More and more frequently, however, we also stumble upon characteristics and skills we would not necessarily have expected from the cliché of the meticulous financial bad cop.

Onno Schüssler, CFO at Körber Supply Chain, for example, is being described as follows: “An important point for him was communication with the portfolio companies: ‘Especially because many former owners are still active, you had to do a lot of convincing here’. He says it was important for him to get a feel for when the time was right for change and how to strike a balance between entrepreneurial freedom and standardization. ‘Here we took a well-measured approach in order to avoid surprises and to align the messaging for the staff’ he says.”

“Von Roeder is not a classic financier. Important strengths for opening up a completely new market with an agile group unit are creativity and the ability to think strategically,” it says about Vonovia CFO Helene von Roeder.

Also: “Sierk Poetting was one of the faces of the corona crisis – on the good side. As CFO of vaccine pioneer Biontech […] he not only courted the public’s trust in the process, but is also in regular dialogue with the federal government.”

New Roles of the CFO

Empathetic change communication, creative market and brand strategies, transparent dialog with the public? All of a sudden, the role of the CFO sounds much more familiar to someone like me, who is committed to brand storytelling.

In fact, according to a 2019 McKinsey study, CFOs now spend a majority of their time, 41 percent, on activities that focus on data-driven decisions across the organization but are not necessarily finance-related. Of the CFOs who said they spend a majority of their time on non-financial tasks, the top 3 issues focused primarily on the following areas:

- Strategic leadership: 46%

- Organizational change: 45%

- Performance management: 35%

Today, more than ever, CFOs are seen as strategists. More and more of them are ultimately rising to the position of CEO of the company. They are also well equipped to do so. After all, the majority of decisions in organizations are based on financial data, which CFOs should know like the back of their hand. But to also manifest the role of strategic interface, it is important that they build a narrative around their financial insights.

Financial Storytelling Must Speak To A Large Audience!

Every financial professional who rises to the position of CFO certainly masters the technical aspects of the job. The role of the modern CFO is therefore all the more about “financial storytelling”; about understanding, exploring and sharing the stories behind the numbers to drive change and decision-making.

In one of our previous blogposts you will get an overview of essential principles of data storytelling.

Like any good narrative, these financial stories should provide a complete arc of where the company has been, where it is now and, more importantly, where it might be headed in the future.

To be successful in their communications, CFOs must be careful not to get stuck in their bubble of financial jargon. When you talk internally to other executives, you’re starting at a different level of abstraction than when you talk to the board, investors, or analysts. And when communicating to employees and the general public, you have to be able to convey your analyses and findings in a much more abstract and generally understandable way.

It is always important to consider at which points the respective audience needs more context. Sometimes this is achieved through additional key figures, sometimes a situation needs to be explained in more detail. It is not just about the financial data alone, but it is always also related to the corporate culture, local and global challenges, or anecdotes that show how the money is distributed.

How Do Financial Gurus Manage to Combine the Rational with the Emotional?

“Success stories abound throughout America. Since our country’s birth, individuals with an idea, ambition and often just a pittance of capital have succeeded beyond their dreams by creating something new or by improving the customer’s experience with something old.

Charlie and I journeyed throughout the nation to join with many of these individuals or their families. On the West Coast, we began the routine in 1972 with our purchase of See’s Candy. A full century ago, Mary See set out to deliver an age-old product that she had reinvented with special recipes.

Added to her business plan were quaint stores staffed by friendly salespeople. Her first small outlet in Los Angeles eventually led to several hundred shops, spread throughout the West.

Today, Mrs. See’s creations continue to delight customers while providing life-long employment for thousands of women and men. Berkshire’s job is simply not to meddle with the company’s success.”

This narrative is not a diary entry, but a passage from the official shareholder report for 2020, penned by Berkshire Hathaway CEO Warren Buffett himself. His approach is as simple as it is revolutionary in financial communication. To keep his remarks both comprehensible and informative, he imagines writing the Financial Report as a letter to his two sisters.

“It’s ‘Dear Doris and Bertie’ at the start and then I take that off at the end, […] I pretend that they’ve been away for a year and I’m reporting to them on their investment.”

(source)

Here you can find more examples of successful CEO letters.

Finance and Data Drive a Company’s Hero’s Journey!

“A company is like a character in a book, going through its own set of life-changing experiences. Part of my role is to pitch Vena’s story to potential new investors. The idea is to engage them in the story of our business’ development, showing its full potential and how they can play a role in realizing it,” says software company Vena Solutions’ CFO Darrell Cox. (source)

Brand storytelling is often based on Vogler’s hero’s journey. In twelve stages, the hero(ine) goes through a journey of transformation, starting from the familiar world, over the threshold to new adventures, allies and enemies, crises, rewards, and back again. Through all these chapters, the protagonist receives not only material rewards, but also a so-called elixir, that is, for example, knowledge, experience, values, which must be carried further into the world after surviving the adventure.

Each business year is peppered with several stages like these. The figures provide the possible thread to connect all these episodes into a narrative that can carry shareholders and internal stakeholders along. And that is precisely one of the most important tasks of a CFO today.

For more financial storytelling inspiration, check out our article on storytelling in annual reports.

Share this article